Impact on AI on UK jobs market divides opinion, says BT survey

IT decision makers are divided about the impact of disruptive technologies such as AI and automation – the so called ‘Fourth Industrial Revolution’ – on the labour market, according to new research from BT.

Contrary to many reports which speculate about widespread job losses, one third of organisations surveyed who plan to implement AI and automation within the next two years believe it will create more jobs within the workplace. This reflects the view that AI will generate new opportunities for programmers, algorithm designers and software engineers and create new job categories such as AI trainers, ethicists and lawyers.

However, the same proportion predict that these technologies could result in job losses in their organisation, given concerns that innovations in robotics and intelligent computer systems may eventually replace jobs traditionally done by humans, particularly those of a manual, repetitive nature.

Other interesting stats include:

- One third of IT decision markers (out of a survey of 1,501) say AI and automation is already being used within their organisation

- Of the one in three IT decision makers planning to invest in AI and automation in the next two years, 62% believe that their organisations will be more effective as a result

- 95% of organisations that operate within the UK public sector are already using at least one form of disruptive technology, such as mobile applications, AI and machine learning, intelligent apps, automated technology, augmented/virtual reality devices and wearable technology

Colm O’Neill, managing director of major corporates and public sector at BT, said: “This research gives us a fascinating insight into the early adoption of AI, automation and other disruptive technologies in the UK workplace. The findings illustrate the rapid pace of technological change amongst organisations of all types and sizes.

“And while some organisations clearly view disruptive technologies as a potential threat to the labour market, we believe the introduction of new automated technologies and business processes will play to the strengths of both people and machines.”

Lack of funds cause UK SMEs to miss out on business opportunities

Retail bank Aldermore has released its SME Future Attitudes – Insight Report for Q1 2017. One interesting stat is that one in five (19%) UK SMEs have lost a business opportunity in the last year due to a lack of funds, with those based in the North East and East Midlands most likely to have missed out. The average amount lost by SMEs because of missed opportunities amounted to £77,651 annually.

The survey also asked businesses what type of funding they use – traditional bank lending still remains the most popular; almost of fifth (18%) of SMEs are funded through overdrafts, conventional bank loans or credit cards provided by the traditional high street banks. 14% of enterprises finance their operations using non-traditional methods such s invoice finance, crowdfunding, peer-to-peer platforms or angel investors.

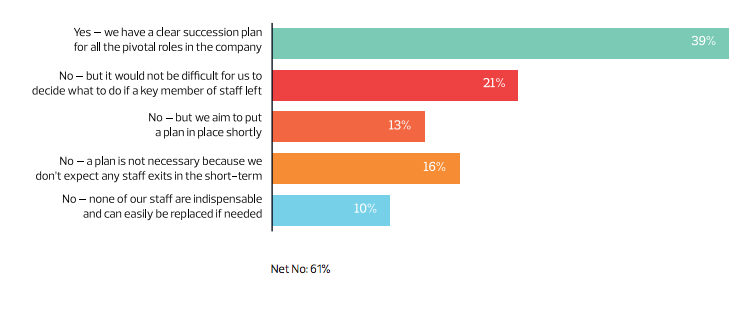

A number of other key questions were asked, including “do you have a plan in place to ensure your business does not suffer when key employees leave?”, to which 39% said yes.

Credit: Aldermore

Carl D’Ammassa, group managing director for business finance at Aldermore, said: “Access to finance is a common and persistent gripe among SMEs in Britain. And a particularly troubling revelation from our report is that one in five companies has missed out on a business opportunity in the past 12 months because of a lack of funding. It may be that many firms do not realise the range of finance now available to them.”

84% of small business owners ‘unaware of GDPR’

A survey from information security company Shred-it has revealed that 84% of UK small business owners and 43% of senior executives of large companies are unaware of the forthcoming General Data Protection Regulation (GDPR).

The survey, which was conducted by IPSOS, also found that:

- Of those in the know, 10% of SMEs and 40% of c-suites have started to take action in preparation

- 40% of small businesses do not believe a data breach would have a significant impact on their company yet 64% of small businesses who have been victim of a breach say it has caused a financial impact. 47% of c-suites say it has caused harm to their credibility and reputation

- 55% of SMEs do not monitor employees removing confidential information from the office (31% of c-suites)

- 21% of large organisations have someone at board level responsible for data security issues in 2017 vs 13% in 2016